You’re wasting your time in direct sales unless you do THIS

Direct selling has long been a way to achieve the financial freedom most of us yearn for. The idea of stepping away from the rigidity of 9-5 jobs and the promise of building an empire right from the comfort of your home is enticing. But here’s the cold, hard truth: unless you understand your “money foundation,” all that time and effort you’re putting into your direct sales business could be for naught.

What is a Money Foundation?

Your “money foundation” refers to your psychological relationship with money — your thoughts, beliefs, and habits concerning your finances. Many think that merely earning more will lead them to financial freedom. While earning potential is undoubtedly important, the real game-changer is understanding your “burn rate,” or how quickly you spend what you earn.

High Earners, Big Burners

To drive home this point, let’s look at some cautionary tales from the world of celebrities and lottery winners. Michael Jackson, who earned over $750 million throughout his career, spent nearly $9.7 million yearly to maintain his Neverland estate. Similarly, boxer Mike Tyson burned through $480 million thanks to his extravagant lifestyle, which cost him $390,000 monthly. Even ordinary people who suddenly come into great wealth, like Lotto winner Janite Lee, who won $18 million, often file for bankruptcy.

The Importance of Financial Education

If you’re in direct sales or any entrepreneurial venture, heed this advice: Before spending on inventory or marketing, invest in your financial education.

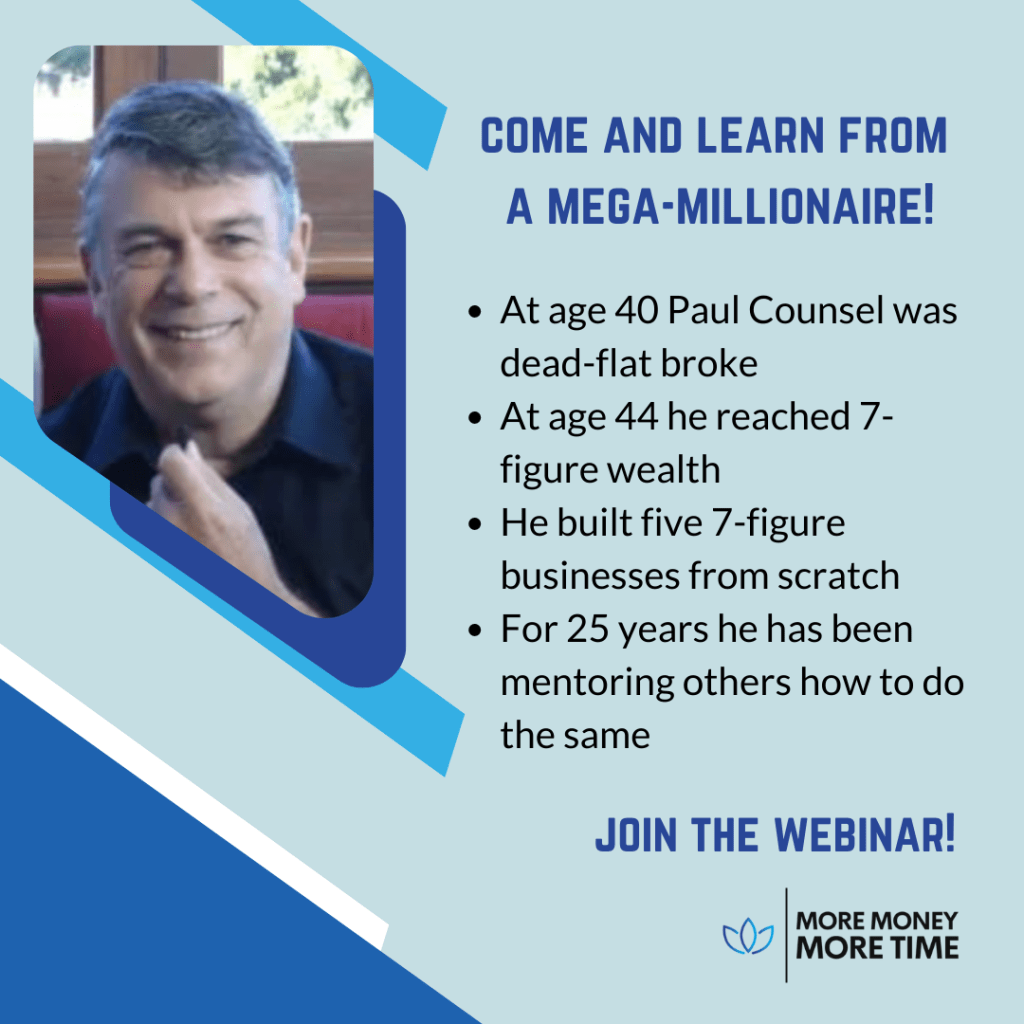

Two decades ago, I had the privilege of working with a money mentor named Paul Counsel. He taught me crucial lessons, such as calculating my ‘burn rate,’ understanding my ‘subconscious money code,’ and investing wisely. Without this foundation, I firmly believe my journey in direct sales would have ended differently.

Revisiting the Basics

Recently, I reconnected with Paul and took his Money Foundations webinar series. Even after achieving an 8-figure business, this course helped me understand that I still had much to learn about creating *sustainable* wealth. It wasn’t about earning more money but controlling and leveraging it wisely.

Here’s Your Golden Opportunity

Because I firmly believe in the power of financial education, I reached out to Paul to offer his 6-Week Money Foundations Webinar Series to my community for free. The series covers various topics, from understanding your money code to strategies for growing your wealth in 2023 and beyond. The live webinars will also feature a Q&A session where you can get your pressing financial questions answered by an expert who has built five 7-figure businesses.

Direct sales can be your ticket to financial freedom. But remember, it’s not how much money you *earn*; it’s how much money you *keep* and *grow* that truly matters. And the first step toward that is building a solid money foundation. This knowledge will empower you to take control of your financial future, allowing you to live the life you’ve always dreamed of.

So don’t miss out on this incredible opportunity to change your life. Register now for Paul’s FREE 6-Week Money Foundations Webinar Series. It’s not just about earning more money; it’s about transforming your financial psychology and unlocking the door to sustainable wealth.